Hot Listing

Buy & Scale: Stable Manufacturing Business with Expansion Upside

Business Description

28-person team, 50% capacity – asset-rich and built to scale

This is a rare opportunity to acquire a U.S.-based precision plastics manufacturer located near Fort Smith, Arkansas — featuring high-capacity equipment, a stable 28-person workforce, and an asset-rich balance sheet with minimal goodwill.

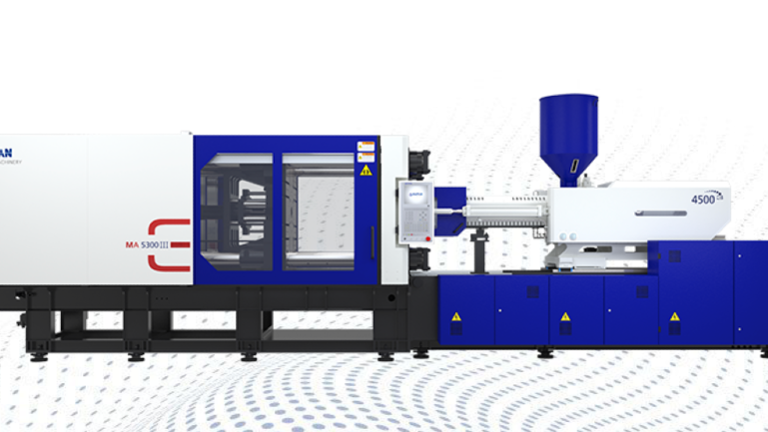

The company specializes in 24/7 custom injection molding and insert molding, supported by custom tooling, in-house assembly, and decades of operational expertise — which has resulted in strong recurring orders and consistent, sustainable operations. Assets include Haitian-brand machines (up to 600-ton capacity), as well as other presses and tooling, compressors, chillers, forklifts, and other essential infrastructure. A full list of equipment is available upon request or via the company website.

The facility is optimized for three-shift operations and is currently staffed accordingly. The team includes trained operators, admin support, and leadership personnel capable of continuing day-to-day operations without ownership involvement.

Unlike many shops of its size, this business is currently operating at only ~50% of its production capacity — not due to a lack of demand, but because the owner has chosen not to actively pursue growth while nearing retirement. In fact, jobs have been turned away. A healthy production run rate would be closer to 85%, which would allow the next owner to significantly increase cash flow without the need for additional capital expenditure.

The business has already been pre-qualified for a $5 million government-backed loan, validating both its financial strength and scalability. The owner previously explored this financing path in preparation for expansion but ultimately chose to retire for personal reasons — creating an excellent opportunity for a new owner to take the next step without starting from scratch.

The seller is offering full training and transition support. Included in the sale is a proprietary AI-powered “Owner Knowledge Chatbot” that allows the new owner to ask operational questions and retrieve best practices from years of experience — a unique, built-in SOP system that reduces risk during the handoff period. Optional consulting is available, and the seller may also consider staying on part-time in a sales or relationship-management role if desired.

Approximately 70% of the purchase price is backed by tangible assets — making this one of the most secure, capital-efficient manufacturing acquisition opportunities in the region. With a well-trained staff in place, custom tooling, and significant excess production capacity, this business is well-positioned for growth.

The business does not require full-time, on-site ownership. While a hands-on operator could accelerate growth quickly, strategic oversight and part-time involvement may be sufficient with strong management in place. This opportunity is ideal for a first-time buyer with operations or sales experience, an investor seeking passive income with asset backing, or a strategic buyer looking for bolt-on production in a favorable U.S. logistics hub.

The company specializes in 24/7 custom injection molding and insert molding, supported by custom tooling, in-house assembly, and decades of operational expertise — which has resulted in strong recurring orders and consistent, sustainable operations. Assets include Haitian-brand machines (up to 600-ton capacity), as well as other presses and tooling, compressors, chillers, forklifts, and other essential infrastructure. A full list of equipment is available upon request or via the company website.

The facility is optimized for three-shift operations and is currently staffed accordingly. The team includes trained operators, admin support, and leadership personnel capable of continuing day-to-day operations without ownership involvement.

Unlike many shops of its size, this business is currently operating at only ~50% of its production capacity — not due to a lack of demand, but because the owner has chosen not to actively pursue growth while nearing retirement. In fact, jobs have been turned away. A healthy production run rate would be closer to 85%, which would allow the next owner to significantly increase cash flow without the need for additional capital expenditure.

The business has already been pre-qualified for a $5 million government-backed loan, validating both its financial strength and scalability. The owner previously explored this financing path in preparation for expansion but ultimately chose to retire for personal reasons — creating an excellent opportunity for a new owner to take the next step without starting from scratch.

The seller is offering full training and transition support. Included in the sale is a proprietary AI-powered “Owner Knowledge Chatbot” that allows the new owner to ask operational questions and retrieve best practices from years of experience — a unique, built-in SOP system that reduces risk during the handoff period. Optional consulting is available, and the seller may also consider staying on part-time in a sales or relationship-management role if desired.

Approximately 70% of the purchase price is backed by tangible assets — making this one of the most secure, capital-efficient manufacturing acquisition opportunities in the region. With a well-trained staff in place, custom tooling, and significant excess production capacity, this business is well-positioned for growth.

The business does not require full-time, on-site ownership. While a hands-on operator could accelerate growth quickly, strategic oversight and part-time involvement may be sufficient with strong management in place. This opportunity is ideal for a first-time buyer with operations or sales experience, an investor seeking passive income with asset backing, or a strategic buyer looking for bolt-on production in a favorable U.S. logistics hub.

About the Business

- Years in Operation

- 21

- Facilities & Assets

- The sale includes a fully equipped injection molding facility with 28 staff and 24/7 operational capability. Assets include multiple injection molding machines (600-ton capacity), custom molds, compressors, dryers, chillers, forklift, and support equipment. The building supports 3-shift operations with warehouse, assembly, and office space. Sale also includes raw materials and finished inventory at closing.

- Market Outlook / Competition

- The business is currently operating at approximately 50% capacity. A healthy run rate would be 85%, which presents a clear opportunity to nearly double output and significantly increase cash flow. With the team, systems, and equipment already in place, this growth can be achieved without major additional investment.

- Opportunities for Growth

- The business operates at ~50% of its production capacity due to the owner’s limited focus on sales, not operational constraints. A motivated owner or sales-driven team could increase volume to a healthy 85% run rate, nearly doubling output and significantly improving cash flow without major new investment.

Real Estate

- Owned or Leased

- Owned

- Included in asking price

About the Sale

- Seller Motivation

- Decades in, owner is retiring and ready to hand off a strong operation.

- Transition Support

- Owner will provide full training and transition support, including operations, quoting, supplier handoff, and scheduling. Optional post-sale consulting available. Business includes an AI-powered “owner knowledge” chatbot. Seller may consider staying on in a part-time sales role if desired.

- Financing Options

- Seller may offer financing on goodwill to approved buyers.

Listing Info

- ID

- 2411701

- Listing Views

- 2778

Listing ID: 2411701 The information on this listing has been provided by either the seller or a business broker representing the seller. BizQuest has no interest or stake in the sale of this business and has not verified any of the information and assumes no responsibility for its accuracy, veracity, or completeness. See our full Terms of Use. Learn how to avoid scams.