Camera Technology Manufacturer for Material Handling Equipment

Business Description

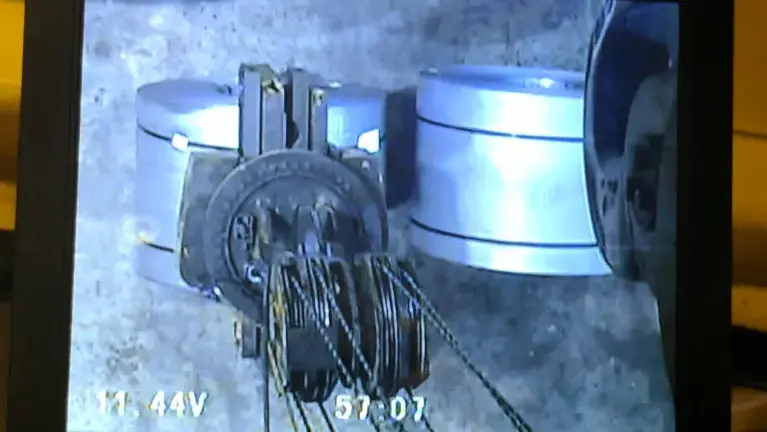

HoistCam is a proven, 13+ year Industrial IoT hardware business delivering rugged, real-time camera visibility for high-risk heavy equipment operations. This is a turnkey acquisition of Netarus, LLC's HoistCam platform and brands. The platform is positioned to merge into a larger organization as a low-friction add-on product line and immediate competitive advantage.

What you are buying

- Turnkey operation with an experienced team in place (3 full-time, 1 part-time). Day-to-day execution is led by a skilled VP of Business Development, supporting smooth transition and immediate continuity.

- Proprietary hardware IP and engineered know-how, including HoistCam's differentiated magnetic mounting system for non-invasive, 5-minute deployment on heavy equipment without drilling or modification.

- Active R&D roadmap: HoistAlert (proximity warning system) is under active pre-release development, providing a near-term new product line and upsell path.

- Established brands and trademarks (HoistCam, TugCam, HoistAlert), plus ownership of key domains (Netarus.com, HoistCam.com) and a lean, SWaM-certified Virginia operational structure.

- Global customer base and an extensive existing sales pipeline built over the past decade, including deployments in high-profile operations such as the Hoover Dam and use across major contractors and industrial facilities (steel and aluminum).

Why this wins in the market

HoistCam serves inelastic demand to overcome equipment blind spots driven by OSHA guidelines and jobsite safety expectations. Tailwinds are strong: Construction IoT (14.1% CAGR) and crane camera systems (11.8% CAGR), with the wireless crane camera segment projected to reach approximately $1.4B in annual revenue by 2025. This is an "arrow in the quiver" for a buyer who wants to compete head-to-head with incumbent camera offerings.

Ideal buyer profiles

- Strategic acquirer (industrial services, lifting and rigging, safety products) seeking a proprietary camera solution and immediate scale.

- OEM, dealer, or rental fleet platform looking for rapid retrofit capability across existing equipment fleets.

- Technology-forward buyer looking to leverage HoistCam's ruggedized real-time video feed as a foundation for machine vision and AI object detection.

Quick growth levers with dedicated ownership

- Convert existing pipeline and scale outbound with a repeatable dealer and rental fleet program.

- Launch HoistAlert with bundled pricing and upgrade paths for the installed base.

- Create OEM retrofit kits and standardize go-to-market packaging for multi-site rollouts.

Transition support

Seller provides structured onboarding (30-60 days) including SOPs, vendor and BOM transfer, sales playbooks, training materials, and warm introductions to key customers and opportunities.

Time-sensitive opportunity

The discounted price is contingent on a cash-on-cash transaction and may offer tax planning benefits for equity purchasers under Virginia's QESD credit (buyer to verify with advisors). Interested buyers can contact to initiate due diligence.

What you are buying

- Turnkey operation with an experienced team in place (3 full-time, 1 part-time). Day-to-day execution is led by a skilled VP of Business Development, supporting smooth transition and immediate continuity.

- Proprietary hardware IP and engineered know-how, including HoistCam's differentiated magnetic mounting system for non-invasive, 5-minute deployment on heavy equipment without drilling or modification.

- Active R&D roadmap: HoistAlert (proximity warning system) is under active pre-release development, providing a near-term new product line and upsell path.

- Established brands and trademarks (HoistCam, TugCam, HoistAlert), plus ownership of key domains (Netarus.com, HoistCam.com) and a lean, SWaM-certified Virginia operational structure.

- Global customer base and an extensive existing sales pipeline built over the past decade, including deployments in high-profile operations such as the Hoover Dam and use across major contractors and industrial facilities (steel and aluminum).

Why this wins in the market

HoistCam serves inelastic demand to overcome equipment blind spots driven by OSHA guidelines and jobsite safety expectations. Tailwinds are strong: Construction IoT (14.1% CAGR) and crane camera systems (11.8% CAGR), with the wireless crane camera segment projected to reach approximately $1.4B in annual revenue by 2025. This is an "arrow in the quiver" for a buyer who wants to compete head-to-head with incumbent camera offerings.

Ideal buyer profiles

- Strategic acquirer (industrial services, lifting and rigging, safety products) seeking a proprietary camera solution and immediate scale.

- OEM, dealer, or rental fleet platform looking for rapid retrofit capability across existing equipment fleets.

- Technology-forward buyer looking to leverage HoistCam's ruggedized real-time video feed as a foundation for machine vision and AI object detection.

Quick growth levers with dedicated ownership

- Convert existing pipeline and scale outbound with a repeatable dealer and rental fleet program.

- Launch HoistAlert with bundled pricing and upgrade paths for the installed base.

- Create OEM retrofit kits and standardize go-to-market packaging for multi-site rollouts.

Transition support

Seller provides structured onboarding (30-60 days) including SOPs, vendor and BOM transfer, sales playbooks, training materials, and warm introductions to key customers and opportunities.

Time-sensitive opportunity

The discounted price is contingent on a cash-on-cash transaction and may offer tax planning benefits for equity purchasers under Virginia's QESD credit (buyer to verify with advisors). Interested buyers can contact to initiate due diligence.

About the Business

- Years in Operation

- 10

- Employees

- 4 (3 Full-time, 1 Part-time)

- Facilities & Assets

- 5 office location in Norfolk, Virginia with existing stock and inventory. Full 3D printing, electrical and manufacturing done on-site.

- Website

- https://www.hoistcam.com

- Market Outlook / Competition

- Established 13+ year brand with a global customer base and active pipeline. 2024 revenue baseline is $600k (per tax returns). Demand is resilient because blind-spot visibility on cranes/heavy equipment is a safety expectation aligned with OSHA-driven guidance. Tailwinds: Construction IoT and crane camera systems growing at double-digit rates; wireless crane camera segment projected ~ $1.4B annual revenue. For strategic buyers, HoistCam is a proprietary add-on to compete with incumbents.

- Opportunities for Growth

- Multiple growth vectors: (1) Launch HoistAlert - proximity warning system already in active pre-release development, creating a new product line and upsell path. (2) Expand OEM and rental-fleet penetration using the proprietary magnetic mount for non-invasive, 5-minute installs. (3) Layer in AI/machine-vision detection on the ruggedized real-time video feed. (4) Cross-sell HoistCam into the acquirer's existing equipment/customer base. Unaudited internal projections ramp sales from ~$645k (2026) to ~$937k (2027) to ~$1.49M (2028).

Real Estate

- Owned or Leased

- Leased

- Building Sq. Ft.

- 1,500

- Rent

- $1,200.00 per month

- Lease Expiration

- 4/1/2027

About the Sale

- Seller Motivation

- The owner is no longer focused on the business full-time. HoistCam is operating

- Transition Support

- Turnkey handoff: 30-60 day onboarding led by current owner + VP of Business Development. Includes full transfer of vendor list, BOMs, assembly/testing SOPs, install/training materials, RMA and troubleshooting scripts, sales playbooks, and warm introductions to key customers and pipeline. Optional ongoing advisory support.

Listing Info

- ID

- 2437214

- Listing Views

- 426

Attached DocumentsAttachment Disclaimer

Listing ID: 2437214 The information on this listing has been provided by either the seller or a business broker representing the seller. BizQuest has no interest or stake in the sale of this business and has not verified any of the information and assumes no responsibility for its accuracy, veracity, or completeness. See our full Terms of Use. Learn how to avoid scams.

Businesses for Sale Manufacturing Businesses for Sale Electronic Equipment Manufacturing Businesses for Sale