Enterprise Facility Access Control Systems, Recurring Service Revenue.

Business Description

NOTE: Gross Revenue, Cash Flow, and EBITDA are averages over the past 5 years.

This business is ideal for a young entrepreneur with a basic knowledge of low-voltage electronics and software, willing to put 100% effort into growing the business. It will not be affected by global tariffs because there are no tariffs on software at this point. The hardware from Mercury Security is manufactured and assembled in Southern California, USA.

Since January 2004, Middleware Associates has been developing software and partnering with other software providers to directly offer facility access control systems to business end users, including large enterprises, hospitals and clinics, universities, and K-12 School Districts. This is a business-to-business industry.

Middleware Associates has also worked with the US Army at Fort Sill in Oklahoma and the US Navy in San Diego. Our software/hardware was chosen to secure the hangars where the Lockheed Martin F-35 Fighter Jets are assembled and stored. Unfortunately, all F-35 contracts were canceled during the Biden administration, which hurt our revenue.

Our business model is quite different from that of a typical security integrator. We sell directly to end users, bypassing third-party installers and integrators. In turn, our gross profit margins are substantially higher (38 to 45%), and the end users require less support because they have IT departments that install the controllers on their networks. Our end users sometimes hire commercial locksmiths or installers to install electromechanical door locks and readers. Our end users pay approximately 60% of the industry average ($3,500/per door). They require very few support calls because they installed themselves and understand the technology.

In addition, we offer Annual Service Level Agreements, which include support, free software upgrades, a 25% discount on all software and hardware, and free shipping. This recurring revenue makes up approximately 25 to 30% of our revenue, which grows annually because our customers are constantly expanding their systems. The average annual SLA price is $100/reader per annum, e.g., a university with a 75-door license pays 7,500 yearly. Our annual SLA's are very profitable, and the customers typically take them because they want our latest software, free support, and the opportunity to expand their system at a discounted rate.

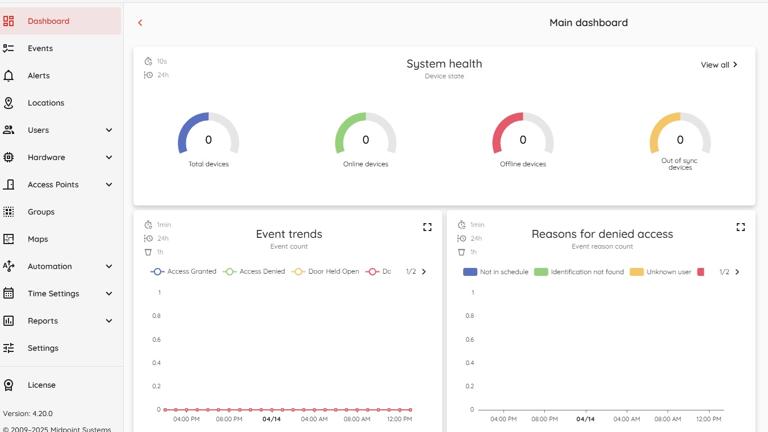

We developed our software from 2004 to 2007. Since 2007, we have partnered with Midpoint Systems in Lithuania because they have better programmers and a similar application to our software. Our partnership with Midpoint Systems is excellent! Our customers make up approximately 90% of the North American market of CredoID installations.

The largest asset of Middleware Associates is, without question, the established customer base, which took 21 years to build up. Any potential acquirer should understand the value of an existing customer base that is very loyal to Middleware Associates.

This business is ideal for a young entrepreneur with a basic knowledge of low-voltage electronics and software, willing to put 100% effort into growing the business. It will not be affected by global tariffs because there are no tariffs on software at this point. The hardware from Mercury Security is manufactured and assembled in Southern California, USA.

Since January 2004, Middleware Associates has been developing software and partnering with other software providers to directly offer facility access control systems to business end users, including large enterprises, hospitals and clinics, universities, and K-12 School Districts. This is a business-to-business industry.

Middleware Associates has also worked with the US Army at Fort Sill in Oklahoma and the US Navy in San Diego. Our software/hardware was chosen to secure the hangars where the Lockheed Martin F-35 Fighter Jets are assembled and stored. Unfortunately, all F-35 contracts were canceled during the Biden administration, which hurt our revenue.

Our business model is quite different from that of a typical security integrator. We sell directly to end users, bypassing third-party installers and integrators. In turn, our gross profit margins are substantially higher (38 to 45%), and the end users require less support because they have IT departments that install the controllers on their networks. Our end users sometimes hire commercial locksmiths or installers to install electromechanical door locks and readers. Our end users pay approximately 60% of the industry average ($3,500/per door). They require very few support calls because they installed themselves and understand the technology.

In addition, we offer Annual Service Level Agreements, which include support, free software upgrades, a 25% discount on all software and hardware, and free shipping. This recurring revenue makes up approximately 25 to 30% of our revenue, which grows annually because our customers are constantly expanding their systems. The average annual SLA price is $100/reader per annum, e.g., a university with a 75-door license pays 7,500 yearly. Our annual SLA's are very profitable, and the customers typically take them because they want our latest software, free support, and the opportunity to expand their system at a discounted rate.

We developed our software from 2004 to 2007. Since 2007, we have partnered with Midpoint Systems in Lithuania because they have better programmers and a similar application to our software. Our partnership with Midpoint Systems is excellent! Our customers make up approximately 90% of the North American market of CredoID installations.

The largest asset of Middleware Associates is, without question, the established customer base, which took 21 years to build up. Any potential acquirer should understand the value of an existing customer base that is very loyal to Middleware Associates.

About the Business

- Years in Operation

- 21

- Employees

- 1

- Currently Relocatable

- Yes

- Currently Home Based

- Yes

- Facilities & Assets

- None. We have customers all over North America and a handful in Central and South America. This business can be managed anywhere in the USA because our services are all via remote connection.

Since 2004, I have managed the business from Florida, Tennessee, and North Carolina, with no adverse effects on our customer base. California, Texas, and Florida comprise a substantial percentage of our customers. - Website

- https://middleware-associates.com/

- Market Outlook / Competition

- The USA access control market generates approximately $6 billion in revenue annually. Controller manufacturers write Application Programming Interfaces so there are 100's of competitors in the USA who can integrate their software to access control. We have the advantage of offering enterprise level features directly to end users for half the price of our competitors.

- Opportunities for Growth

- Pros:

1. Our number one software is CredoID. We promote and support directly to end users.

2. Recurring Revenue from Service Level Agreements

Cons:

1. We have not invested enough in sales and marketing because our continued growth mainly came from word of mouth and Google Advertising.

2. I own other businesses and have not been 100% engaged in growing the company. It pretty much runs on autopilot.

About the Sale

- Seller Motivation

- Retiring.

- Transition Support

- As the founder, I am willing to stay on board for 1 month to train the new owner on all aspects and procedures of Middleware Associates.

- Financing Options

- Cash Deal - No Owner Financing *** SALE PENDING ***

Listing Info

- ID

- 1929494

- Listing Views

- 1473

Attached DocumentsAttachment Disclaimer

MA_6_years_Financials_Profit_and_Loss_2_.pdf

Business Location

Listing ID: 1929494 The information on this listing has been provided by either the seller or a business broker representing the seller. BizQuest has no interest or stake in the sale of this business and has not verified any of the information and assumes no responsibility for its accuracy, veracity, or completeness. See our full Terms of Use. Learn how to avoid scams.

Businesses for SaleNorth Carolina Businesses for SaleNorth Carolina Technology Businesses for SaleNorth Carolina Other Technology Businesses for Sale