Est. 41-Year Family Medicine Practice for Sale – Arlington, TX (DFW)

Business Description

Turn-key opportunity with loyal multi-generational patients

Well-established, solo-physician Family Medicine practice available for acquisition in Arlington, Texas, in the heart of the Dallas–Fort Worth metroplex. Founded in 1984, this practice has operated continuously for more than 41 years and has maintained an uninterrupted presence in the same medical office complex since 1993—offering exceptional continuity of care and deep community trust.

The practice focuses on adult primary care, delivering a full range of services including preventive care, chronic disease management (hypertension, diabetes, hyperlipidemia, cardiovascular risk), acute illness evaluation, medication management, in-office lab testing, immunizations, and coordination of specialty referrals. The clinical model is straightforward, relationship-driven, and built on long-term patient loyalty.

In 2025, the practice recorded 3,285 patient encounters and 159 new patients, supported by 1,359 active patients and 4,266 total patient records. The patient population skews toward middle-aged and older adults (45–75+), with strong Medicare penetration—making the panel well suited for value-based care programs, Annual Wellness Visits, Chronic Care Management (CCM), and population health initiatives.

Operations run on a lean, highly experienced team: one full-time physician and two full-time support staff with an average tenure exceeding 20 years. This stability minimizes transition risk and training burden for a new owner. The practice uses AdvancedMD as its EHR (since 2017), supports online scheduling, patient portal communication, and telemedicine, and maintains a no-show rate under 5%.

Five-year gross revenues have ranged from $352K to $427K. Two-year average Seller's Earnings (2023–2024) are $201,208, reflecting stable owner income from a mature, efficiently operated practice. The asking price of $245,000 includes $195,000 cash at close and a $50,000 seller-carryback note for a qualified buyer. Accounts receivable are excluded.

This is an ideal opportunity for an individual physician seeking a turnkey, autonomous practice—or for a strategic buyer, multi-site operator, or PE-backed platform looking for a low-risk tuck-in acquisition in the DFW market with established payer contracts, excess provider capacity, and multiple levers for post-acquisition growth.

Goodwill, trade names, phone numbers, furniture, equipment, and supplies are included. Lease is 1,676 sq. ft. at $3,097/mo through April 2027.

The practice focuses on adult primary care, delivering a full range of services including preventive care, chronic disease management (hypertension, diabetes, hyperlipidemia, cardiovascular risk), acute illness evaluation, medication management, in-office lab testing, immunizations, and coordination of specialty referrals. The clinical model is straightforward, relationship-driven, and built on long-term patient loyalty.

In 2025, the practice recorded 3,285 patient encounters and 159 new patients, supported by 1,359 active patients and 4,266 total patient records. The patient population skews toward middle-aged and older adults (45–75+), with strong Medicare penetration—making the panel well suited for value-based care programs, Annual Wellness Visits, Chronic Care Management (CCM), and population health initiatives.

Operations run on a lean, highly experienced team: one full-time physician and two full-time support staff with an average tenure exceeding 20 years. This stability minimizes transition risk and training burden for a new owner. The practice uses AdvancedMD as its EHR (since 2017), supports online scheduling, patient portal communication, and telemedicine, and maintains a no-show rate under 5%.

Five-year gross revenues have ranged from $352K to $427K. Two-year average Seller's Earnings (2023–2024) are $201,208, reflecting stable owner income from a mature, efficiently operated practice. The asking price of $245,000 includes $195,000 cash at close and a $50,000 seller-carryback note for a qualified buyer. Accounts receivable are excluded.

This is an ideal opportunity for an individual physician seeking a turnkey, autonomous practice—or for a strategic buyer, multi-site operator, or PE-backed platform looking for a low-risk tuck-in acquisition in the DFW market with established payer contracts, excess provider capacity, and multiple levers for post-acquisition growth.

Goodwill, trade names, phone numbers, furniture, equipment, and supplies are included. Lease is 1,676 sq. ft. at $3,097/mo through April 2027.

About the Business

- Years in Operation

- 42

- Employees

- 2 Full-time

- Facilities & Assets

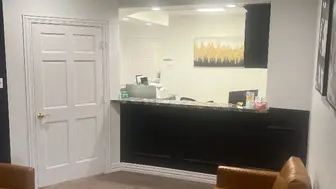

- 1,676 sq. ft. single-level medical office in an established complex. Includes 3 exam rooms, 1 physician office, 1 lab, 1 MA/nursing station, 2 storage rooms, reception with seating for 8, and separate patient/staff restrooms. Layout supports adding an NP or PA without expansion. Lease at $3,097/mo through April 2027.

- Market Outlook / Competition

- Arlington, TX (pop. ~395,000) sits at the center of the DFW metroplex—home to 8M+ residents. The 10-mile population exceeds 904,000 and is projected to reach 947,000 by 2029. A diversified local economy, balanced demographics, and growing Medicare-eligible population drive sustained demand for adult primary care. The practice draws patients from Arlington, Grand Prairie, Mansfield, and surrounding communities, with loyal patients also traveling from DeSoto, Crowley, Cleburne, and Granbury.

- Opportunities for Growth

- Immediate opportunities include deploying an NP/PA to increase visit volume using existing space, optimizing Medicare Annual Wellness Visits, and extending hours to capture unmet demand. Medium-term levers include CCM, TCM, and RPM program enrollment; integration into payer quality and value-based care programs; and targeted digital marketing to adult and senior populations. No formal marketing has ever been done—organic growth only—creating significant upside from even modest outreach investment.

Real Estate

- Owned or Leased

- Leased

- Building Sq. Ft.

- 1,676

- Rent

- $3,097.00 per month

- Lease Expiration

- 4/30/2027

About the Sale

- Seller Motivation

- Planned retirement after 46+ years of medical practice.

- Transition Support

- Owner will provide a transition period with term, compensation, and schedule by mutual agreement to ensure continuity of patient relationships and staff operations. Two long-tenured staff members (avg. 20+ years) are expected to remain. In-house training achieves front-office independence in 2–4 weeks and clinical support readiness in 4–6 weeks.

- Financing Options

- $50,000

Listing Info

- ID

- 2468938

- Listing Views

Listing ID: 2468938 The information on this listing has been provided by either the seller or a business broker representing the seller. BizQuest has no interest or stake in the sale of this business and has not verified any of the information and assumes no responsibility for its accuracy, veracity, or completeness. See our full Terms of Use. Learn how to avoid scams.