Local pharmacy in a plaza - Passaic County NJ

Business Description

2025 Gross Revenue: $1,886,491.23

Script Total: ~7,600

Brand vs. Generic: 27% / 73%

Script Count: Steady volume of ~7600 scripts annually (30/daily avg)

Infrastructure: Recently underwent $200,000 in high-end renovations, offering a modern, clinical, and welcoming environment.

Ease of Transition: The current Staffing Pharmacist (SP) is willing to remain post-sale at a base pay of $70/hour, ensuring immediate continuity.

Growth Ready: Currently operating only 5 days per week, providing a massive immediate upside for a buyer willing to expand to weekend or evening hours.

Full Credentialing: All major insurance plans are accepted with no notable exclusions or PBM issues.

Ownership: current owner has owned for 4 years

Location & Market Demographics

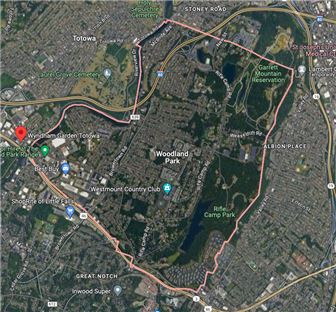

The pharmacy is situated in a high-visibility, easily accessible location within Woodland Park, designed to capture both local foot traffic and commuter patients.

Accessibility: Ample dedicated parking and proximity to local medical providers and healthcare clinics in the same plaza.

Demographics: Woodland Park boasts a stable population density with a strong median household income.

Senior Market: A significant percentage of the local population is aged 65+, the highest-utilizing demographic for pharmacy services.

Competitive Landscape: While there is competition within a 3-5 mile radius, this pharmacy’s boutique service model and modernized facility provide a distinct competitive advantage over big-box retailers.

Prescription Volume & Operational Analysis

The pharmacy maintains a consistent, manageable volume with high growth potential through operational expansion.

Mix: Diverse blend of new prescriptions and recurring refills. (Detailed Generic vs. Name-brand mix available via Micro Merchant reports).

Expansion Opportunity: Revenue is currently capped by a 40-hour work week. Extending hours to 6 or 7 days per week could potentially increase script volume by 20–30% based on local demand.

OTC Sales: ~$3,000 / month

Wholesale Suppliers & Inventory Management

The business benefits from a "Dual-Wholesaler" strategy, ensuring supply chain resilience and competitive pricing.

Primary Suppliers: Kinray and McKesson.

Advantages: Access to the two largest distributors in the U.S. ensures reliable next-day delivery, aggressive rebate programs, and strong purchasing power.

Systems: Fully integrated with Micro Merchant pharmacy management software for seamless inventory tracking and e-prescribing.

Inventory Turnover: Lean inventory management practices are in place, maximizing cash flow.

Facility, Equipment & Assets

Rent & Lease Terms:

Monthly Rent: $5,000

Lease Term: 10 Years (New or assumable)

Security: Long-term lease ensures the buyer can amortize the acquisition over a full decade with predictable occupancy costs

Terms: Lease includes standard assignment provisions for a seamless business transfer

Staffing & Transition Support

The business is currently "turnkey" from a staffing perspective, requiring minimal recruitment efforts post-closing.

Current Staff: 2 Employees (1 Pharmacist, 1 Technician).

Retention: The Staff Pharmacist (SP) is willing to stay at $70/hr, providing the buyer with immediate professional coverage.

Seller Support: The selling pharmacist is committed to a smooth transition, including training on local physician relationships and operational workflows.

Must sign an NDA

Script Total: ~7,600

Brand vs. Generic: 27% / 73%

Script Count: Steady volume of ~7600 scripts annually (30/daily avg)

Infrastructure: Recently underwent $200,000 in high-end renovations, offering a modern, clinical, and welcoming environment.

Ease of Transition: The current Staffing Pharmacist (SP) is willing to remain post-sale at a base pay of $70/hour, ensuring immediate continuity.

Growth Ready: Currently operating only 5 days per week, providing a massive immediate upside for a buyer willing to expand to weekend or evening hours.

Full Credentialing: All major insurance plans are accepted with no notable exclusions or PBM issues.

Ownership: current owner has owned for 4 years

Location & Market Demographics

The pharmacy is situated in a high-visibility, easily accessible location within Woodland Park, designed to capture both local foot traffic and commuter patients.

Accessibility: Ample dedicated parking and proximity to local medical providers and healthcare clinics in the same plaza.

Demographics: Woodland Park boasts a stable population density with a strong median household income.

Senior Market: A significant percentage of the local population is aged 65+, the highest-utilizing demographic for pharmacy services.

Competitive Landscape: While there is competition within a 3-5 mile radius, this pharmacy’s boutique service model and modernized facility provide a distinct competitive advantage over big-box retailers.

Prescription Volume & Operational Analysis

The pharmacy maintains a consistent, manageable volume with high growth potential through operational expansion.

Mix: Diverse blend of new prescriptions and recurring refills. (Detailed Generic vs. Name-brand mix available via Micro Merchant reports).

Expansion Opportunity: Revenue is currently capped by a 40-hour work week. Extending hours to 6 or 7 days per week could potentially increase script volume by 20–30% based on local demand.

OTC Sales: ~$3,000 / month

Wholesale Suppliers & Inventory Management

The business benefits from a "Dual-Wholesaler" strategy, ensuring supply chain resilience and competitive pricing.

Primary Suppliers: Kinray and McKesson.

Advantages: Access to the two largest distributors in the U.S. ensures reliable next-day delivery, aggressive rebate programs, and strong purchasing power.

Systems: Fully integrated with Micro Merchant pharmacy management software for seamless inventory tracking and e-prescribing.

Inventory Turnover: Lean inventory management practices are in place, maximizing cash flow.

Facility, Equipment & Assets

Rent & Lease Terms:

Monthly Rent: $5,000

Lease Term: 10 Years (New or assumable)

Security: Long-term lease ensures the buyer can amortize the acquisition over a full decade with predictable occupancy costs

Terms: Lease includes standard assignment provisions for a seamless business transfer

Staffing & Transition Support

The business is currently "turnkey" from a staffing perspective, requiring minimal recruitment efforts post-closing.

Current Staff: 2 Employees (1 Pharmacist, 1 Technician).

Retention: The Staff Pharmacist (SP) is willing to stay at $70/hr, providing the buyer with immediate professional coverage.

Seller Support: The selling pharmacist is committed to a smooth transition, including training on local physician relationships and operational workflows.

Must sign an NDA

About the Business

- Employees

- 2 Full-time

1 Pharmacists, 1 Technician. Both will stay. - Facilities & Assets

- The physical assets of this pharmacy represent a significant portion of the acquisition value, reducing the need for future capital expenditure.

Asset Valuation: $500,000 (Equipment + Patient Files & Goodwill).

Recent Investment: $200,000 in recent facility upgrades.

Technical Inventory:

State-of-the-art dispensing systems.

Medical-grade refrigeration for biologics/vaccines.

Modern Security and POS systems.

Modern, high-efficiency pharmacy layout. - Opportunities for Growth

- Revenue is currently capped by a 40-hour work week. Extending hours to 6 or 7 days per week could potentially increase script volume by 20–30% based on local demand.

Real Estate

- Owned or Leased

- Leased

- Rent

- $5,000.00 per month

Listing Info

- ID

- 2453577

- Listing Views

- 111

Listing ID: 2453577 The information on this listing has been provided by either the seller or a business broker representing the seller. BizQuest has no interest or stake in the sale of this business and has not verified any of the information and assumes no responsibility for its accuracy, veracity, or completeness. See our full Terms of Use. Learn how to avoid scams.

Businesses for SaleNew Jersey Businesses for SaleNew Jersey Health & Medical Businesses for SaleNew Jersey Pharmacies Businesses for Sale