Hot Listing

Owner Absentee Pain Management Clinic Located in Miami, FL

Business Description

Please Read to make sure you qualify before submitting an inquiry:

In Florida, a pain management clinic must generally be wholly owned by licensed physicians (MDs or DOs) who meet specific specialty criteria (like anesthesiology, physiatry, etc.) or by a physician group. If the clinic isn't fully physician-owned, it needs a Health Care Clinic License from the Agency for Health Care Administration (AHCA) and must be registered with the Department of Health (DOH), often requiring an exemption. Non-physician owners can exist but face complex regulations, often needing AHCA licensing and ensuring compliance with Florida's strict Corporate Practice of Medicine (CPOM) laws, with the designated physician remaining responsible for patient care

Owner Absentee Pain Management Clinic

Asking Price: $330,000

Highlights:

- Started 2014

- Owner not involved in the business

- 1 doctor and 1 office manager (Both employees will stay)

- Lease is month to month but landlord would sign longer

- Never increased rent in 5 years

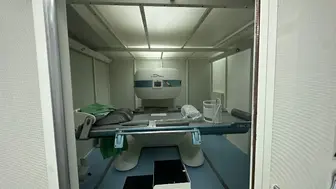

- 2300 sqft

- Huge waiting room, 3 medical offices

- Office manager gets paid $75,000

- 2025 numbers are the same as 2024

- $15,000 in inventory and FF&E (furniture, equipment, computers, printers, inventory)

- 170 recurring patients per month

- No advertising

- Would need to be cash or I have a lender that would help with the financing. Buyer just needs to have a credit score of 700+

- Reason for the sale: Owner is putting this money towards flipping properties

2024:

From Tax Return:

Gross: $457,668

Addbacks:

Compensation of officers: $65,000 (not involved in the business)

Wife salary: $11,000 (not involved in the business)

Ordinary business income: $52,746

Adjusted net income for 2024: $128,746

2023:

From Tax Return:

Gross: $465,813

Addbacks:

Compensation of officers: $65,000 (not involved in the business)

Wife salary: $11,000 (not involved in the business)

Ordinary business income: $62,186

Adjusted net income for 2023: $138,186

2022:

From Tax Return

Gross: $439,106

Addbacks:

Compensation of officers: $62,500 (not involved in the business)

Wife salary: $11,000 (not involved in the business)

Ordinary business income: $65,859

Adjusted net income for 2022: $139,359

Broker: Matt Millsaps

Florida License #3439771

In Florida, a pain management clinic must generally be wholly owned by licensed physicians (MDs or DOs) who meet specific specialty criteria (like anesthesiology, physiatry, etc.) or by a physician group. If the clinic isn't fully physician-owned, it needs a Health Care Clinic License from the Agency for Health Care Administration (AHCA) and must be registered with the Department of Health (DOH), often requiring an exemption. Non-physician owners can exist but face complex regulations, often needing AHCA licensing and ensuring compliance with Florida's strict Corporate Practice of Medicine (CPOM) laws, with the designated physician remaining responsible for patient care

Owner Absentee Pain Management Clinic

Asking Price: $330,000

Highlights:

- Started 2014

- Owner not involved in the business

- 1 doctor and 1 office manager (Both employees will stay)

- Lease is month to month but landlord would sign longer

- Never increased rent in 5 years

- 2300 sqft

- Huge waiting room, 3 medical offices

- Office manager gets paid $75,000

- 2025 numbers are the same as 2024

- $15,000 in inventory and FF&E (furniture, equipment, computers, printers, inventory)

- 170 recurring patients per month

- No advertising

- Would need to be cash or I have a lender that would help with the financing. Buyer just needs to have a credit score of 700+

- Reason for the sale: Owner is putting this money towards flipping properties

2024:

From Tax Return:

Gross: $457,668

Addbacks:

Compensation of officers: $65,000 (not involved in the business)

Wife salary: $11,000 (not involved in the business)

Ordinary business income: $52,746

Adjusted net income for 2024: $128,746

2023:

From Tax Return:

Gross: $465,813

Addbacks:

Compensation of officers: $65,000 (not involved in the business)

Wife salary: $11,000 (not involved in the business)

Ordinary business income: $62,186

Adjusted net income for 2023: $138,186

2022:

From Tax Return

Gross: $439,106

Addbacks:

Compensation of officers: $62,500 (not involved in the business)

Wife salary: $11,000 (not involved in the business)

Ordinary business income: $65,859

Adjusted net income for 2022: $139,359

Broker: Matt Millsaps

Florida License #3439771

About the Business

- Years in Operation

- 12

- Employees

- 2 Full-time

- Facilities & Assets

- 2300 sq ft with huge waiting room and 3 medical offices

- Market Outlook / Competition

- Recurring patients monthly that are pretty dedicated to this specific pain clinic

- Opportunities for Growth

- Owner does no advertising so it could be expanded.

Real Estate

- Owned or Leased

- Leased

- Building Sq. Ft.

- 2,300

- Rent

- $4,000.00 per month

- Lease Expiration

- 3/31/2026

About the Sale

- Seller Motivation

- Owner is putting this money towards flipping properties

- Transition Support

- Owner will help transition but he is absentee the 2 employees would be the most help during transition.

- Financing Options

- Cash or I have a lender that could help with the financing.

Listing Info

- ID

- 2455323

- Listing Views

- 359

Listing ID: 2455323 The information on this listing has been provided by either the seller or a business broker representing the seller. BizQuest has no interest or stake in the sale of this business and has not verified any of the information and assumes no responsibility for its accuracy, veracity, or completeness. See our full Terms of Use. Learn how to avoid scams.

Businesses for SaleFlorida Businesses for SaleFlorida Health & Medical Businesses for SaleFlorida Medical Practices Businesses for Sale