Fintech offering Net-terms on invoices to the construction industry

Business Description

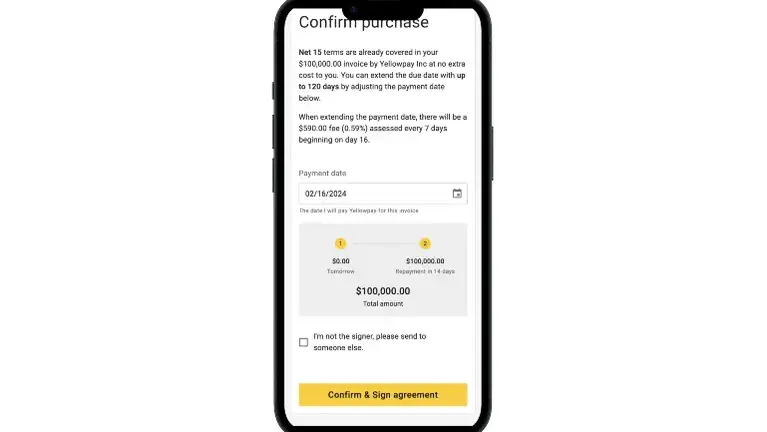

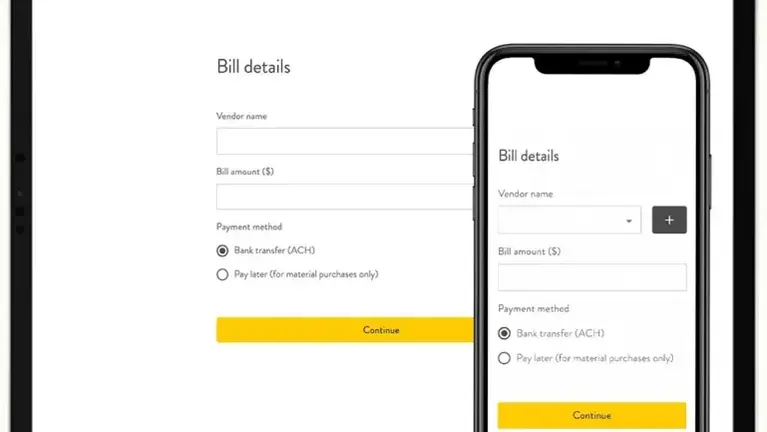

Yellowpay is an established fintech company specializing in flexible payment solutions for the construction industry. Founded in 2022, the business operates a sophisticated platform that enables construction material sellers to offer extended payment terms up to NET-120 on invoices, addressing critical cash flow challenges in the construction sector.

BUSINESS MODEL:

The company generates revenue by facilitating flexible payment terms between sellers and buyers in the construction materials space. We are currently making 50+% Internal Rate of Return. All credit is fully insured against loss through strategic banking partnerships, providing robust risk management. The platform is expanding to offer comprehensive banking services including business accounts and debit cards.

FINANCIAL PERFORMANCE:

- Annual Revenue: $1,200,000

- Extended Internal Rate of Return: 50%+

- Net Return on Capital: ~30%

- Year-over-Year Growth: 150% (2024-2025)

- Platform Volume: $18 million processed in 2025

MARKET POSITION:

Yellowpay serves a specialized niche with 250+ active buyers and 150+ sellers on the platform. Primary customers include companies in construction energy solutions, energy storage, and data center development - high-growth sectors driving substantial demand.

COMPETITIVE ADVANTAGES:

- Established relationships with 400+ platform participants

- Full credit insurance protection eliminates default risk

- Strategic banking partnerships for funding capabilities

- Recurring revenue model with strong customer retention

- Expansion pathway to full-stack banking services

GROWTH OPPORTUNITIES:

The business is positioned for significant expansion through its planned banking services rollout and the continued growth of the construction technology sector. The recurring revenue model and insured credit structure provide stable cash flows while maintaining growth potential.

This established fintech operation offers investors exposure to the rapidly growing construction payments sector with proven financial performance and clear expansion opportunities.

BUSINESS MODEL:

The company generates revenue by facilitating flexible payment terms between sellers and buyers in the construction materials space. We are currently making 50+% Internal Rate of Return. All credit is fully insured against loss through strategic banking partnerships, providing robust risk management. The platform is expanding to offer comprehensive banking services including business accounts and debit cards.

FINANCIAL PERFORMANCE:

- Annual Revenue: $1,200,000

- Extended Internal Rate of Return: 50%+

- Net Return on Capital: ~30%

- Year-over-Year Growth: 150% (2024-2025)

- Platform Volume: $18 million processed in 2025

MARKET POSITION:

Yellowpay serves a specialized niche with 250+ active buyers and 150+ sellers on the platform. Primary customers include companies in construction energy solutions, energy storage, and data center development - high-growth sectors driving substantial demand.

COMPETITIVE ADVANTAGES:

- Established relationships with 400+ platform participants

- Full credit insurance protection eliminates default risk

- Strategic banking partnerships for funding capabilities

- Recurring revenue model with strong customer retention

- Expansion pathway to full-stack banking services

GROWTH OPPORTUNITIES:

The business is positioned for significant expansion through its planned banking services rollout and the continued growth of the construction technology sector. The recurring revenue model and insured credit structure provide stable cash flows while maintaining growth potential.

This established fintech operation offers investors exposure to the rapidly growing construction payments sector with proven financial performance and clear expansion opportunities.

About the Business

- Years in Operation

- 4

- Employees

- 4 Full-time

2 Developers and 2 operational - Website

- https://getyellowpay.com/

- Opportunities for Growth

- Can add bank accounts and debit cards. The service is available for all companies in US as long as the insurance company insure the credit.

Listing Info

- ID

- 2467302

- Listing Views

Attached DocumentsAttachment Disclaimer

Listing ID: 2467302 The information on this listing has been provided by either the seller or a business broker representing the seller. BizQuest has no interest or stake in the sale of this business and has not verified any of the information and assumes no responsibility for its accuracy, veracity, or completeness. See our full Terms of Use. Learn how to avoid scams.

Businesses for SaleCalifornia Businesses for SaleCalifornia Financial Businesses for SaleCalifornia Banking Institutions Businesses for Sale